Managing money can sometimes feel like juggling flaming torches while riding a skateboard—one wrong move, and things can go up in flames! 🔥💸

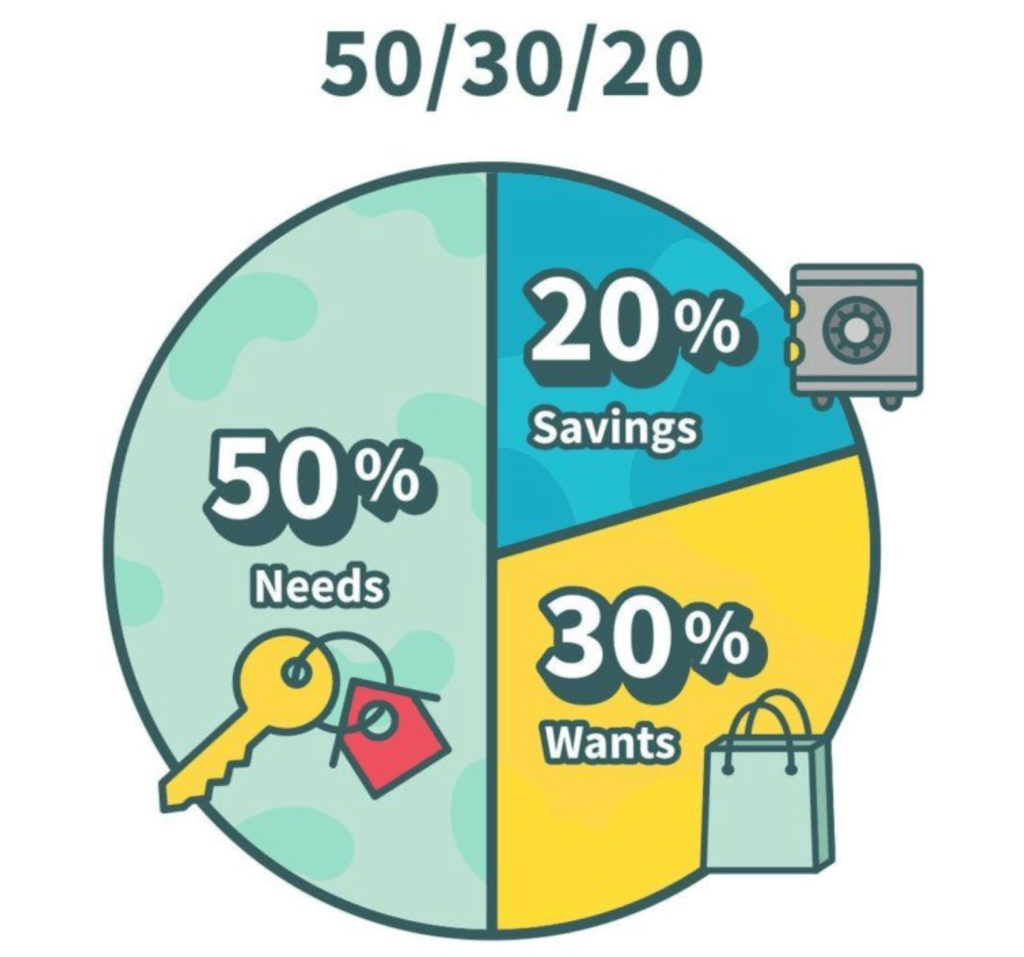

With so many budgeting methods out there, it’s easy to feel overwhelmed. But don’t worry—we’re here to break them down for you. One of the simplest, no-fuss strategies that can help you divide your income like a pro (without breaking a financial sweat) is the 50/30/20 rule.

That said, let’s keep it real—the 50/30/20 rule isn’t a magical fix for everyone. Life isn’t one-size-fits-all, and neither is budgeting. But if you’re looking for a solid starting point, this method is a great way to gain control over your money. So, let’s dive into it!🚀

50% – Needs (a.k.a The Adulting Fund)

This is where half of your income (yes, half!) goes to the essentials—things that keep you alive and functioning like a responsible human.

Think of it as the part of your budget that says, “Hey, I need a roof over my head and food on my plate.” This includes rent or mortgage, utilities, groceries, insurance, minimum debt payments, and transportation. Basically, if you can’t live without it, it belongs in this category.

Real-Life Example: If you earn $3,000 a month, $1,500 should go toward necessities. So before you sign up for that luxury gym membership or daily overpriced coffee habit, make sure your needs are covered first!

30% – Wants (a.k.a The Fun Fund)

Here’s where the fun happens! This part of your income is for non-essential but enjoyable things—because life shouldn’t just be about paying bills and waiting to die.

This covers dining out, entertainment, streaming subscriptions, travel, hobbies, and yes, that extra-large caramel macchiato with oat milk.

Real-Life Example: Using our $3,000 salary, you get $900 to spend guilt-free. So go ahead, book that weekend getaway or buy those concert tickets—just don’t go overboard and start dipping into your rent money!

20% – Savings & Debt Repayment (a.k.a The Future You Fund)

This is where you set yourself up for financial success. 20% of your income should go toward saving, investing, and paying off any extra debt beyond the minimum payments. Think emergency funds, retirement accounts, and investments.

Your future self will thank you when you don’t have to survive on instant noodles at age 65.

Real-Life Example: From your $3,000 income, $600 should go towards savings and extra debt payments. If you don’t have an emergency fund, this is the first place to start. Once that’s covered, you can start investing for the long term.

Why This Rule Works

The 50/30/20 rule is simple, flexible, and ensures that you’re covering your basics, enjoying life, and securing your financial future—all without needing to track every penny like a detective. It keeps your spending in check while still giving you room to have fun.

Is the 50/30/20 Rule Right for You?

The 50/30/20 rule is a great budgeting framework, but it’s not a perfect fit for everyone. Here’s why:

🔹 High Cost of Living – In expensive cities, 50% for needs isn’t enough. Rent alone can take up most of your income.

🔹 Low-Income Households – When money is tight, necessities come first. Saving 20% may not be realistic.

🔹 High Earners Can Save More – If you make more, you don’t need to spend 30% on wants—investing more is smarter.

🔹 Debt & Priorities – If you have high-interest debt, paying it off faster is better than following a set formula.

🔹 Life Stages Matter – A single person and a parent have different financial needs. Budgets should be flexible.

💡 Bottom line: Use 50/30/20 as a guide, not a rule—adjust it to fit your life! 🚀💰

Leave a comment