Buying a home is a huge milestone, but for most of us, it comes with a mortgage—and a lot of interest payments over the years. Unless you’ve inherited a fortune, paying off your mortgage as quickly as possible can save you a massive amount of money, especially on your primary residence (investment properties may be a different story).

Here’s how you can manage to pay off the mortgage faster while saving the most money along the way.

The Power of an Offset Account

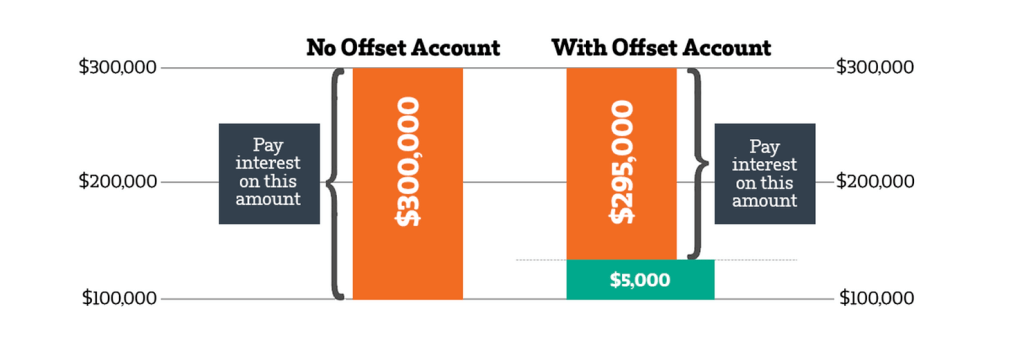

One of the best tools for reducing mortgage interest is an offset account, which is linked to your mortgage. The money in this account reduces the balance on which interest is charged, helping you pay off your loan faster. Surprisingly, many people don’t fully understand how powerful this strategy can be.

Let’s break it down:

📌 If you have a $300,000 mortgage at 4% interest, you’d pay over $215,000 in interest over 30 years—bringing your total cost to $515,000!

📌 At 5% interest, the amount you pay in interest is nearly the same as your loan—yikes!

📌 But by using an offset account, you can cut down on interest and shorten your loan term dramatically.

A simple way to maximise this is to deposit your salary straight into your offset account. This means every dollar in the account is reducing your mortgage interest while still being available when you need it.

Offset Account vs. Savings Account

Some people wonder whether they should have a separate savings account while also holding an offset account. Here’s the key thing to remember:

💰 The interest rate on a mortgage is always higher than the interest rate on a savings account.

💰 This means the money saved on mortgage interest is more valuable than any interest earned in a savings account.

💰 So, keeping your savings in an offset account makes more financial sense.

What about an emergency fund? The beauty of an offset account is that it keeps your money accessible while still reducing your mortgage interest. Unlike a redraw facility, where you may need to contact your lender to access funds, an offset account gives you instant access to your money when you need it.

Using a Credit Card to Your Advantage

Many lenders offer a credit card with an offset account as part of a package. While credit cards often get a bad reputation, they can actually be a useful tool if used strategically.

Here’s how you can make it work:

🛒 Use the credit card for everyday expenses instead of dipping into your offset account.

📅 Take advantage of the interest-free period (usually around 30–55 days).

💳 Pay off the full balance by the due date to avoid interest charges.

By doing this, your salary and savings stay in your offset account longer, reducing interest charges every single day. The key to making this work? You need to be disciplined with your budget and spending!

Final Thoughts

There’s no one-size-fits-all approach to paying off a home loan, but this sure is one of the effective methods.

🔹 Use an offset account to minimise interest.

🔹 Keep savings in your offset rather than a separate account.

🔹 Use a credit card strategically to maximise interest savings.

Of course, everyone’s financial situation is different, so it’s important to find an approach that suits your circumstances. But if paying off your mortgage faster while saving thousands in interest sounds good to you—this strategy is definitely worth considering! 🚀🏡

Leave a comment