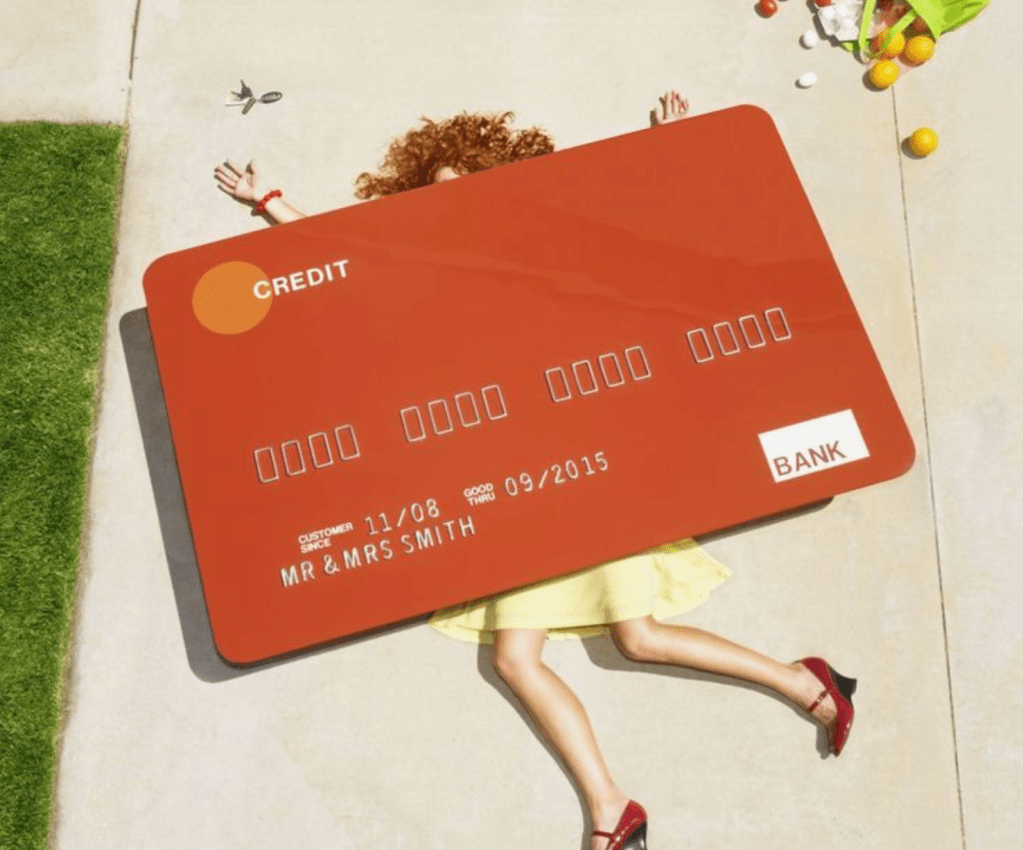

Credit cards can be powerful financial tools, offering convenience, rewards, and even financial flexibility. However, when not used wisely, they can also lead to financial stress and unnecessary debt. Many people unknowingly make mistakes with their credit cards that cost them money in the long run. Let’s explore some of the most common credit card pitfalls and how you can avoid them.

1. Only Paying the Minimum Balance

The Mistake: Paying just the minimum amount due each month might seem manageable, but it can lead to long-term debt and hefty interest charges.

How to Avoid It: Always aim to pay off your full balance each month. If that’s not possible, pay as much as you can above the minimum to reduce interest costs and clear your debt faster.

2. Carrying a Balance to Improve Your Credit Score

The Mistake: Some people believe that keeping a balance on their credit card helps build their credit score. In reality, it only results in unnecessary interest payments.

How to Avoid It: Pay off your balance in full each month. Your credit score benefits more from on-time payments and low credit utilisation rather than carrying a balance.

3. Overspending for Rewards

The Mistake: Rewards programs can be tempting, but spending beyond your means just to earn points, cashback, or travel perks can lead to financial trouble.

How to Avoid It: Stick to your budget and only use your credit card for necessary expenses you can afford to pay off. Treat rewards as a bonus, not a reason to overspend.

4. Ignoring Your Credit Card Statement

The Mistake: Many people neglect to review their monthly statements, which can lead to missing fraudulent transactions or being charged for mistakes.

How to Avoid It: Regularly check your credit card statement for any unauthorised charges or errors. Report any suspicious activity immediately to your bank.

5. Maxing Out Your Credit Limit

The Mistake: Using your entire credit limit can hurt your credit score and make it harder to manage payments.

How to Avoid It: Keep your credit utilisation below 30% of your limit. If you find yourself frequently maxing out your card, consider requesting a higher limit (but only if you can use it responsibly) or working on reducing your expenses.

6. Missing Payment Due Dates

The Mistake: Late payments not only result in late fees but can also negatively impact your credit score.

How to Avoid It: Set up automatic payments or reminders to ensure you never miss a due date. Paying on time helps build a strong credit history and keeps your account in good standing.

7. Applying for Too Many Credit Cards at Once

The Mistake: Every credit card application results in a hard inquiry on your credit report, which can temporarily lower your credit score.

How to Avoid It: Only apply for a new credit card when necessary and space out your applications to minimise the impact on your credit score.

Final Thoughts

Credit cards are useful financial tools, but avoiding common mistakes is key to using them responsibly. By paying your balance in full, spending within your means, and keeping an eye on your statements, you can enjoy the benefits of credit cards without falling into financial pitfalls. Smart credit card habits will help you maintain good financial health and avoid unnecessary debt.

Use your credit wisely, and it will work for you—not against you!

Leave a comment